All Categories

Featured

Table of Contents

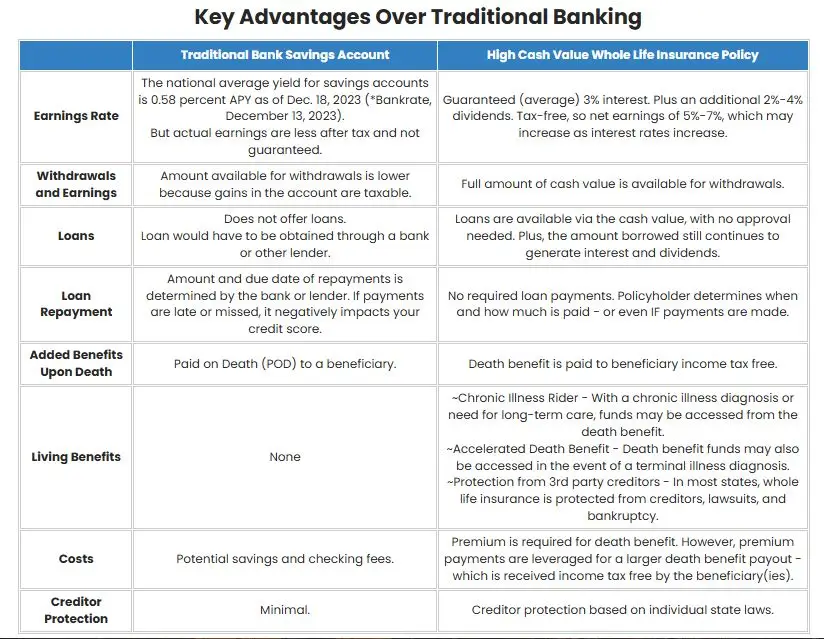

The are whole life insurance policy and universal life insurance policy. expands cash money value at an ensured rate of interest and additionally through non-guaranteed dividends. expands cash value at a fixed or variable rate, relying on the insurance company and plan terms. The money value is not added to the survivor benefit. Cash value is a function you capitalize on while active.

After one decade, the cash money worth has actually expanded to about $150,000. He gets a tax-free funding of $50,000 to start a company with his bro. The policy car loan rate of interest rate is 6%. He settles the loan over the following 5 years. Going this course, the interest he pays goes back right into his plan's cash money value rather than a financial establishment.

Non Direct Recognition Life Insurance

Nash was a money expert and follower of the Austrian college of business economics, which advocates that the worth of products aren't explicitly the result of standard financial frameworks like supply and demand. Rather, people value cash and products differently based on their financial standing and needs.

Among the risks of typical financial, according to Nash, was high-interest rates on financings. As well several people, himself included, entered into monetary problem because of reliance on financial establishments. Long as banks set the rate of interest prices and financing terms, individuals really did not have control over their own riches. Becoming your own banker, Nash determined, would certainly place you in control over your financial future.

Infinite Financial requires you to possess your monetary future. For goal-oriented people, it can be the finest monetary device ever. Below are the advantages of Infinite Financial: Arguably the solitary most helpful aspect of Infinite Banking is that it boosts your cash circulation.

Dividend-paying entire life insurance coverage is extremely low threat and supplies you, the insurance holder, a terrific deal of control. The control that Infinite Financial supplies can best be organized into 2 groups: tax obligation benefits and possession securities.

Whole Life Concept

When you utilize whole life insurance for Infinite Banking, you get in into a private agreement between you and your insurance business. These protections may differ from state to state, they can consist of protection from possession searches and seizures, security from reasonings and protection from creditors.

Entire life insurance policies are non-correlated possessions. This is why they work so well as the financial structure of Infinite Financial. Regardless of what occurs in the market (supply, actual estate, or otherwise), your insurance coverage policy retains its worth.

Entire life insurance coverage is that 3rd container. Not just is the rate of return on your entire life insurance coverage policy ensured, your death benefit and premiums are additionally guaranteed.

Right here are its major benefits: Liquidity and access: Policy car loans provide instant access to funds without the limitations of typical bank loans. Tax effectiveness: The money value expands tax-deferred, and plan car loans are tax-free, making it a tax-efficient tool for building wide range.

How Do I Start Infinite Banking

Possession protection: In many states, the cash worth of life insurance policy is safeguarded from lenders, including an added layer of financial security. While Infinite Banking has its merits, it isn't a one-size-fits-all remedy, and it features significant downsides. Here's why it may not be the very best strategy: Infinite Banking often requires detailed plan structuring, which can perplex policyholders.

Picture never ever needing to stress over financial institution financings or high rates of interest once more. Suppose you could obtain cash on your terms and construct riches simultaneously? That's the power of unlimited financial life insurance coverage. By leveraging the cash value of entire life insurance policy IUL plans, you can expand your riches and borrow cash without counting on traditional banks.

There's no set loan term, and you have the freedom to decide on the settlement routine, which can be as leisurely as paying off the lending at the time of fatality. This versatility reaches the servicing of the fundings, where you can select interest-only settlements, maintaining the car loan equilibrium flat and convenient.

Holding money in an IUL taken care of account being credited interest can usually be better than holding the cash on deposit at a bank.: You have actually always desired for opening your very own bakery. You can borrow from your IUL policy to cover the preliminary expenses of leasing a space, purchasing tools, and working with team.

Infinite Bank

Individual lendings can be gotten from standard financial institutions and credit score unions. Borrowing cash on a credit report card is generally extremely costly with annual percentage prices of interest (APR) frequently reaching 20% to 30% or even more a year.

The tax obligation therapy of plan loans can vary substantially relying on your nation of residence and the certain regards to your IUL plan. In some regions, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, policy finances are generally tax-free, supplying a considerable benefit. In other territories, there may be tax obligation effects to take into consideration, such as potential taxes on the lending.

Term life insurance coverage only supplies a death advantage, without any kind of money worth build-up. This indicates there's no cash worth to borrow against.

However, for finance policemans, the extensive regulations enforced by the CFPB can be seen as difficult and restrictive. First, financing police officers commonly say that the CFPB's policies produce unneeded red tape, resulting in more documentation and slower car loan processing. Rules like the TILA-RESPA Integrated Disclosure (TRID) policy and the Ability-to-Repay (ATR) needs, while targeted at shielding customers, can lead to delays in shutting offers and raised functional prices.

Latest Posts

Nash Infinite Banking

Infinite Banking With Whole Life Insurance

Privatized Banking Concept